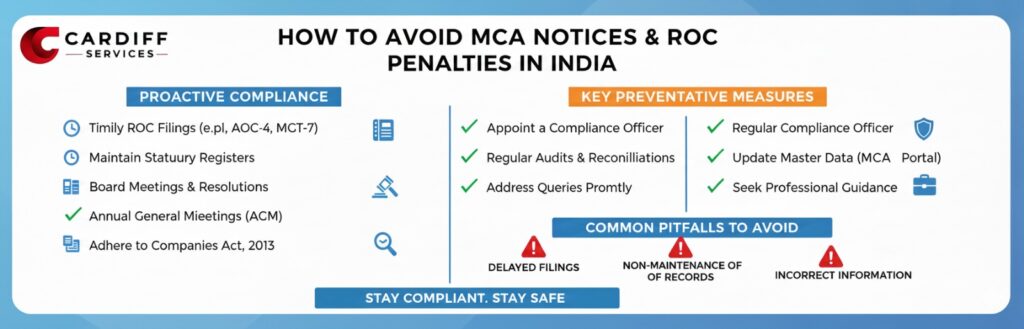

Proper Steps to Avoid MCA Notices & ROC Penalties

Maintain a Compliance Calendar

Keep track of all ROC filing deadlines, board meetings, and annual compliances to ensure no due date is missed and all legal requirements are followed on time.

File ROC Forms on Time

Submit all ROC forms such as AOC-4, MGT-7, and DIR-12 within deadlines with correct details to avoid late fees, errors, and unwanted scrutiny.

Conduct Board Meetings and AGM Properly

Hold board meetings and annual general meetings as per legal timelines with proper notices, resolutions, and documented minutes.

Complete Director KYC Every Year

Ensure all directors file DIR-3 KYC annually before the due date to prevent DIN deactivation and additional penalty charges.

Appoint and Update Statutory Auditor

Appoint the statutory auditor on time and file ADT-1 with ROC to remain compliant and avoid penalties.

Respond Quickly to MCA Notices

Always reply to MCA notices within the given time, along with required explanations and documents, to reduce the risk of higher penalties.

Hire a Professional Company Secretary

A Company Secretary monitors compliance, files forms accurately, and manages MCA communications, helping companies stay compliant and penalty-free.

Penalties for Non-Compliance

- Heavy late fees charged daily for delayed or missed filings

- Director disqualification due to continuous non-compliance with MCA rules

- Legal action and prosecution in serious compliance default cases

How Cardiff Service Helps You Stay MCA-Compliant

Proactive Compliance Management

We track all ROC and MCA deadlines in advance, ensuring timely filings and continuous compliance to prevent notices, penalties, and last-minute stress for companies and directors.

- Regular compliance tracking

- Timely filing reminders

Accurate and Error-Free Filings

Our team prepares and reviews all ROC forms carefully to avoid mistakes, incorrect disclosures, and rejections that may trigger MCA notices or penalties.

- Verified data and documents

- Zero-error filing process

Quick MCA Notice Handling

We respond promptly to MCA notices with proper explanations, supporting documents, and professional representation to minimize penalties and resolve issues efficiently.

- Timely notice responses

- Proper documentation support

Dedicated Company Secretary Support

Clients receive ongoing guidance from an experienced Company Secretary who manages all statutory requirements and keeps businesses updated with regulatory changes.

Ongoing compliance support